SUMMARY OF THE SUBSCRIPTION AGREEMENT AND POWER OF ATTORNEY OF

CAJUN UNDERWRITERS RECIPROCAL EXCHANGE

Cajun Underwriters Reciprocal Exchange, a reciprocal insurance exchange organized under the laws of the State of Louisiana (the “Exchange”), existing for the benefit of the Subscribers of the Exchange (the “Joint Subscribers”). As a Reciprocal Insurance Exchange, the Exchange is an unincorporated association of subscribers operating through the contractual arrangements set forth in that certain Subscription Agreement and Power of Attorney (the “Subscription Agreement”), which is attached hereto and which all Joint Subscribers must sign. Under Louisiana law and pursuant to this Subscription Agreement, the Exchange and its Joint Subscribers appoint a third- party, known as an “Attorney-in-Fact,” to manage and administer the day-to-day business operations and affairs of the Exchange on behalf of the Joint Subscribers.

The attached Subscription Agreement provides the terms of your relationship with the Exchange and appoints Cajun Underwriters Risk Management, LLC, a Delaware Limited Liability Company (the “AIF”), as the Attorney-in-Fact of the Exchange. Please carefully review the attached Subscription Agreement and sign below to acknowledge your intention to be legally bound by the terms and conditions of this Subscription Agreement.

This Summary and Cover Letter (the “Cover Letter”) provides an overview of certain key provisions of this Subscription Agreement, as follows:

Non-Assessable Policies: Section 22:175 of the Louisiana Insurance Code provides, in pertinent part, that a domestic reciprocal insurer may issue policies without contingent liability of the Subscriber for assessment upon approval of the Commissioner of Insurance and upon compliance with the following requirements: (i) The Exchange shall have and at all times maintain a surplus as determined from its last annual statement, which is at least equal to the minimum capital and the paid in surplus required on organization of a domestic stock insurer organized under the provisions of the Louisiana Insurance Code; and (ii) the Exchange shall have submitted a copy of its proposed non-assessable policy or policies for approval of the Commissioner of Insurance and shall have obtained his approval thereof. Accordingly, your liability as a Subscriber of the Exchange is limited to the premium contribution specified in your policy only if the unencumbered surplus of the Exchange is at least equal to the minimum capital stock and minimum surplus required of a stock property and casualty company.

Surplus Contributions: Along with your policy premium, you will pay a surplus contribution to the Exchange, which will help lower the cost of capital necessary for the Exchange to operate and will allow the Exchange to offer more competitively priced insurance to its Joint Subscribers. This contribution will be collected along with your policy premium and is set at ten percent (10% ) of total annual premium. For any given year, the AIF will have the discretion to lower the required surplus contribution, based on the capital needs of the Exchange.

Management of the Exchange: You will be appointing and designating the AIF to be the Attorney-in-Fact for the Exchange. As the Attorney-in-Fact, the AIF will manage all of the insurance operations of the Exchange on behalf of you and all of the other Joint Subscribers.

Subscribers’ Advisory Committee: The Exchange has established a Subscribers’ Advisory Committee (“SAC”) for the benefit of its Joint Subscribers. The SAC, an advisory body selected by the AIF, will oversee the finances and operations of the Exchange to assure conformity with the Subscription Agreement and to represent the rights of the J o i nt Subscribers under the Subscription Agreement. The SAC will provide Joint Subscribers with an avenue for expressing their thoughts in connection with the operation of the Exchange. The Exchange will indemnify SAC members for, and you will agree not to sue them in connection with, their service on the SAC.

Management Compensation: In exchange for services rendered, the Exchange will compensate the AIF as follows:

( i ) underwriting and marketing management services provided to the Exchange, the AIF will receive as compensation an amount equal to seventeen percent (17%) of the annual gross premium written by the Exchange.

-

claims management services for non-catastrophic claims pursuant to the attached Claims Service Fee Schedule, plus an amount equal to 3% of the annual gross premium written by the Exchange

-

claims management services for catastrophic claims pursuant to a Claims Service Fee Schedule agreed upon by the AIF.

The AIF is authorized to utilize the funds of the Exchange to pay the expenses of the Exchange, including the cost of any director and officer liability insurance coverages for the AIF and members of the SAC. These compensation arrangements are governed by the Attorney-in-Fact Agreement.

Subscriber Savings Accounts: The Exchange conducts its operations for the benefit of its Joint Subscribers and, as a result, it may, in its discretion, allocate underwriting profits or surplus growth to its Joint Subscribers. To this end, the AIF shall establish Subscriber Savings Accounts (“SSAs”) for each active Subscriber of the Exchange. SSAs are notional accounts held for active Joint Subscribers. To the extent that the AIF determines to return to the Joint Subscribers any underwriting profits or any surplus growth in years without underwriting profit, such amounts will be allocated to Joint Subscribers’ SSAs. Any such distributions will be subject to the performance of the Exchange, its ability to pay claims, and its overall financial strength. Funds may be allocated to SSAs subject to the prior written approval of the Louisiana Department of Insurance.

Arbitration: You, the Exchange, and the AIF agree that that any and all disputes or differences, under the Subscription Agreement, shall be submitted to arbitration before a panel of three arbitrators, each of whom shall be an active or retired disinterested officer of a property and casualty insurance company. One arbitrator shall be chosen

by the Subscriber, one arbitrator shall be chosen by the AIF on behalf of the Exchange, and the third arbitrator will be chosen by the other two arbitrators.

Assignment of Benefits: You understand and agree that you may not, without the prior written consent of the AIF, assign Subscriber’s rights or obligations under this Subscription Agreement, in whole or in part, either voluntarily or by operation of law, and any attempt to make such an assignment in violation of this agreement shall be a default of the Subscription Agreement and such assignment shall be null and void and of no force or effect.

The above is only a summary of certain of the provisions of the Subscription Agreement and does not purport to describe all of the terms of the Subscription Agreement. The summary is qualified in its entirety by reference to the complete text of the Subscription Agreement, which is attached hereto. You are urged to carefully read the Subscription Agreement in its entirety because it is the primary legal document that governs your contractual relationship with the Exchange, the AIF, and the SAC.

By signing below you agree, among other things, to become a Subscriber of the Exchange, to appoint the AIF as the Attorney-in-Fact of the Exchange and to be legally bound by the terms and conditions of the Subscription Agreement.

Due to the nature of the structure of the Exchange, your insurance policy cannot become effective without a signed Subscription Agreement. If you fail to sign this Cover Letter or the Subscription Agreement, the Exchange reserves the right to terminate your coverage.

|

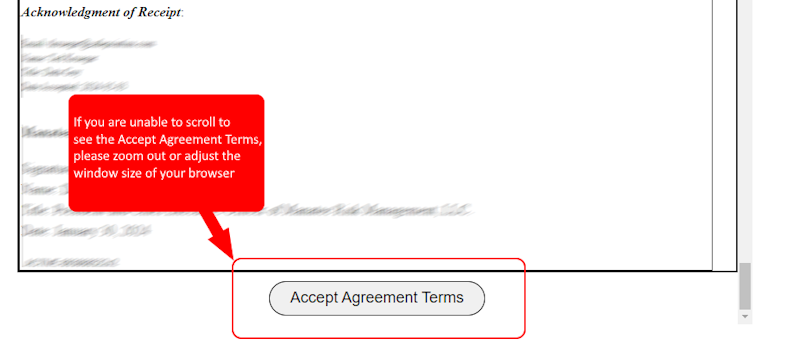

Acknowledgment of Receipt:

Cajun Underwriters Reciprocal Exchange

Signature:

Name: David Flitman

Title: President and Chief Executive Officer of Manatee Risk Management, LLC.

Date: January 30, 2024

|

The undersigned subscriber (the “Subscriber”) to Cajun Underwriters Reciprocal Exchange, a Reciprocal Insurance Exchange formed under the laws of the State of Louisiana (the “Exchange”), by signing this Subscription Agreement and Power of Attorney (the “Subscription Agreement”) and the Summary and Cover Letter (the “Cover Letter”) attached hereto agrees with all other Joint Subscribers to the Exchange (the “Joint Subscribers”), and with Cajun Underwriters Risk Management, LLC, a Delaware Limited Liability Company (the “AIF”), as follows:

-

Power of Attorney.

-

Designation. The Subscriber hereby appoints the AIF as the Attorney-in-Fact for the Exchange with the express power, authority, and permission to effectuate and conduct the lawful business affairs of the Exchange. This authority includes the ability to carry out all customary functions of a reciprocal insurance company, including but not limited to the following responsibilities: (a) exchange, with other Joint Subscribers to the Exchange, any and all kinds of reciprocal insurance contracts, which the Exchange is authorized by law to write; (b) issue, exchange, renew, non-renew, cancel or modify insurance policies; (c) act as intermediary to obtain reinsurance; (d) appear for, compromise, prosecute, adjust, settle, defend, litigate, appeal, and pay claims or losses under the insurance policies of Joint Subscribers; (e) accept service of process on behalf of the Exchange in actions against the Exchange upon contracts exchanged by Joint Subscribers of the Exchange; (f) authorize the Office of the Secretary of State of Louisiana to receive service of process in actions against the Exchange upon contracts exchanged by Joint Subscribers of the Exchange;

(g) open accounts and borrow money in the name of the Exchange; (h) hire and compensate personnel and agents; (i) collect premiums and invest and reinvest funds; (j) receive notices and proof of loss; (k) administer subscriber accounts, including their respective Subscriber Savings Accounts, if applicable, including allocations thereto and distributions therefrom; and (l) to conduct the business and affairs of the Exchange, as set forth herein, in the organizational documents of the Exchange, and that certain Attorney-in-Fact Agreement between the Exchange and the AIF (the “Attorney-in-Fact Agreement”).

-

Limited Power of Attorney. The powers, rights, obligations, and responsibilities of the AIF are limited to those enumerated and described in this Subscription Agreement and in the Attorney-in-Fact Agreement.

-

Offices of Attorney-In-Fact. The offices of the AIF will be the same as the principal office of the Exchange, located at 3321 Hessmer Ave, Suite 302, Metairie, Louisiana 70002. The offices of the Exchange or the AIF may be changed in compliance with the requirements of the laws of the State of Louisiana and the Subscriber will be promptly notified of any such change of office location and when any such change shall be effective.

-

Attorney-in-Fact Agreement. The Attorney-in-Fact Agreement between the Exchange and the AIF, which establishes the AIF as the Attorney-in-Fact for the Exchange, is incorporated herein by reference.

-

Compensation of the AIF.

-

Fees for Services. In consideration for the services provided to the Exchange and under the terms of the Attorney-in-Fact Agreement, the AIF will be compensated for underwriting and marketing management services provided to the Exchange. The AIF will receive as compensation an amount equal to seventeen percent (17%) of the annual gross premium written by the Exchange. In addition, the Exchange will compensate the AIF for claims management services for non-catastrophic claims pursuant to the attached Claims Service Fee Schedule, plus an amount equal to 3% of the annual gross premium written by the Exchange. Compensation for catastrophic claims are also set forth in the attached Claims Service Fee Schedule.

-

Adjustments and Modifications. The AIF’s total compensation, as set forth in greater detail in the Attorney-in-Fact Agreement, may be revised or modified at any time, subject to the prior written approval of the Louisiana Department of Insurance.

2.3. Waiver of Fees. At the sole discretion of the AIF, the AIF may waive fees from the Exchange as a method to build or maintain surplus in the Exchange.

2.4 Expenses. The Exchange will be liable, and will reimburse the AIF on demand, for losses, loss adjustment expenses, investment expenses, and other expenses attributable to the operations of the Exchange.

-

Exchange of Policies: The Subscriber hereby offers and agrees to exchange policies with the other Joint Subscribers of the Exchange. The Subscriber understands and agrees that the reciprocal insurance contracts to be exchanged hereunder are non-assessable, as provided for in Section 22:175 of the Louisiana Insurance Code, and consistent with Section 16 of this Subscription Agreement, thereby limiting the liability of the Subscriber to the Exchange to the policy premium and surplus contribution which are provided for under Section 5 of this Subscription Agreement.

-

Subscribers’ Advisory Committee:

-

Formation and Role of SAC. The Subscriber understands that the Exchange and the AIF have established a Subscribers’ Advisory Committee (the “SAC”) to exercise any rights reserved to J oi n t Subscribers and assist the AIF in supervising the operations of the Exchange. The duties and powers of the SAC are contained within the Subscribers’ Committee Charter (“SAC Charter”). The Subscriber understands and agrees that the powers of the SAC are limited to those enumerated in the SAC Charter and in this Subscription Agreement. Members of the SAC are selected annually by the SAC and the Subscriber agrees that the SAC shall (a) have only the enumerated responsibilities specifically assigned to it, (b) exercise the rights of all Joint Subscribers of the Exchange, and (c) consist of at least two-thirds current insured Joint Subscribers of the Exchange who are independent of the AIF. The Subscriber understands and agrees that the Subscriber is not entitled to directly participate in the management of the Exchange unless such Subscriber is appointed to serve as a member of the SAC.

-

Supervisory Powers of SAC. The Subscriber agrees that the SAC will supervise the finances and operations of the Exchange to the extent as is necessary to assure conformity with

2

this Subscription Agreement and the Attorney-in-Fact Agreement. The SAC also shall procure, at the expense of the Exchange, an audit of the accounts and records of the Exchange and the AIF.

-

Indemnification of SAC Members. To the extent permitted by law, the Subscriber agrees that the Exchange shall defend and hold harmless each and every member of the SAC from and against any liability that may arise from, or is in any way connected with, such member’s participation on the SAC. This indemnification provision does not apply where the member acted with criminal intent or reckless disregard in the performance of his or her duties as a member of the SAC. The Subscriber also agrees that such Subscriber will not sue or name in any action or affirmative defense any SAC member or the SAC for actions arising from, or is in any way connected with, such member’s participation on the SAC.

-

Surplus Contributions.

-

Policy Premium and Surplus Contributions. The Subscriber agrees to pay his or her policy premium when due and, in addition, to make a contribution to the surplus of the Exchange in the amounts and during the period of time set forth in 5.2 below (the “Surplus Contribution”). The Subscriber understands and agrees that the amounts paid as Surplus Contribution will be credited as policyholder surplus for the benefit and protection of all of the Joint Subscribers and that any such Surplus Contribution made to the Exchange is not to be treated as premium for insurance coverage provided by the Exchange to any Subscriber. If the Subscriber chooses to pay the policy premium, surplus contribution or any deposit thereon in cash, payment can be made in person at the Offices of the AIF as identified in section 1.3 above.

-

Timing and Amounts of Surplus Contributions. The Surplus Contribution is payable to the Exchange on or prior to the initial effective date of the Subscriber’s coverage, and subsequently due annually at the same time as the payment of the policy premium is due. The Surplus Contribution shall be ten percent (10%) of total annual insurance premiums (and may be charged at a lower rate, or not at all, in the discretion of the AIF).

-

Return of Surplus Contributions. The Subscriber understands and agrees that the amounts paid as a Surplus Contribution will be credited as policyholder surplus for the benefit and protection of all the Joint Subscribers of the Exchange, are not premiums for insurance, and may only be returned in limited circumstances. The Subscriber further understands and agrees that the ability of the Exchange to return Surplus Contributions to its Joint Subscribers is subject to the provisions of this Subscription Agreement and is limited by law. Upon the issuance of an insurance policy, or other confirmation of coverage by the Exchange, the return of Surplus Contribution can occur only with the approval of the AIF and the Louisiana Department of Insurance, and as set forth in this Subscription Agreement. In the event of a mid-term policy cancellation, the AIF will return any Surplus Contribution (without interest) applicable to the cancelled policy term, pro-rated based on the fraction of the policy term that has elapsed and subject to the restrictions set forth in Section 6 hereof and any applicable law. All other Surplus Contribution amounts, including those made for previous policy terms, will be retained by the Exchange for the benefit of all remaining Joint Subscribers. The Subscriber understands and agrees that any other return of Surplus Contributions will be subject to the approval of the AIF, the Louisiana Department of Insurance, and the restrictions set forth in Section 6 hereof.

-

Subscriber Savings Accounts. The AIF intends to operate the Exchange for the benefit of all of its Joint Subscribers and will maintain separate individual Subscriber Savings Accounts (“SSAs”) 3

for each subscriber. In years in which the Exchange achieves operating profit and surplus growth, after accounting for paid losses, loss reserves and operating and policy acquisition expenses, the AIF, in its discretion, may credit your SSA with a portion of the amount of the Exchange’s growth in surplus for a fiscal year. Any such credit will be made pro rata, based on the Subscriber’s earned premium for such year. The Subscriber understands and agrees that (a) any contributions to be made to a Subscriber’s SSA are based on the Exchange’s overall results, not the results of any individual subscriber; and (b) any and all such funds allocated to the Subscriber would be considered part of the Exchange’s surplus and the AIF would be authorized to use any and all such funds to pay any unsatisfied obligations of the Exchange. As set forth in this Subscription Agreement, the Subscriber may be eligible for a distribution from its SSA (y) at such time when the Subscriber is no longer insured by the Exchange, or (z) at such other times, in determined by the AIF in its discretion, subject to the approval of the SAC. In order to avoid any impairment to the surplus of the Exchange, the AIF, subject to the approval of the SAC, retains the right to limit the distribution from the SSAs to Joint Subscribers whose coverage has been terminated. Furthermore, any payment or allocation to an SSA would be subject to the approval of the Louisiana Department of Insurance.

-

Limitations on Distributions of Surplus Contributions and SSAs. No payment of a returned Surplus Contribution or a distribution of SSA funds (together, a “Surplus Distribution”) will be made if such payment could risk the financial impairment of the Exchange. Surplus Distribution payments may be delayed if, as determined by the AIF, the total amount of such payments to all applicable Joint Subscribers to the Exchange, within the preceding 12 months, would exceed the lesser of: (a) ten percent (10%) of the total surplus of the Exchange calculated as of the immediately preceding December 31, or (b) the total net income of the Exchange before savings allocations and federal income taxes for the calendar year ended as of the immediately preceding December 31. If payment to any subscriber would be delayed pursuant to the requirements set forth in this Section 7, the total amount which may be paid to all Joint Subscribers will be paid pro rata to each such subscriber who meets the conditions to receive a Surplus Distribution on an equitable basis as determined by the AIF in its sole and absolute discretion and as allowed by applicable law. Any payments delayed pursuant to the requirements set forth in this Section 7 will be paid as soon as possible when payment can be made in compliance with this Section 7 and the requirements of the Exchange. If this Section 7 is found to conflict with other terms of this Subscription Agreement, this Section 7 supersedes all other terms and conditions of this Subscription Agreement.

-

Advance of Money by Attorney-in-Fact. The Subscriber understands and agrees that the AIF may advance to the Exchange any amount of money necessary to conduct the business of the Exchange, including any amount necessary to enable the Exchange to comply with a legal requirement. Subject to the approval of the Louisiana Department of Insurance, the advanced amount and any agreed interest on that amount, not exceeding two percent (2%) a year (should the AIF decide to impose such interest):

(i) is payable only from the surplus of the Exchange remaining after providing for all reserves, other liabilities, and required surplus; and (ii) may not otherwise be a liability or claim against the Exchange or any of the assets of the Exchange. The Subscriber further understands and agrees that a commission, promotion expense, or other bonus may not be paid in connection with the

advance of money to the Exchange and that the amount of each advance must be reported in the annual report of the Exchange.

-

Return of Surplus upon Liquidation. The Subscriber understands and agrees that upon the liquidation of the Exchange, the assets of the Exchange remaining after discharge of its indebtedness and policy obligations, the return of any contributions of the AIF or other persons to its surplus made, and the return of any unused premium, savings, or credits then standing on SSAs, shall be distributed to its Joint Subscribers who were such within the 12 months prior to the last termination of its certificate of authority, according to such reasonable formula as the Louisiana Department of Insurance approves.

-

Rejection of Coverage. The Subscriber understands and agrees that the Exchange has an obligation to its Joint Subscribers to maintain strict eligibility and underwriting requirements. The Exchange has the right to reject any application for insurance, including this Subscription Agreement, and the offer of payment of premium and Surplus Contribution. If such a rejection of coverage occurs after receipt of the Surplus Contribution by the Exchange, the Surplus Contribution will be returned to the Subscriber, without payment of interest. An existing subscriber applying for additional lines of coverage is not guaranteed acceptance for those new lines of coverage.

-

Termination: This Subscription Agreement may be terminated at any time, by the Subscriber or the AIF, by terminating all insurance policies issued to the Subscriber, subject to applicable policy provisions and applicable law. Upon the termination of all insurance policies issued to the Subscriber, subject to the approval of the Louisiana Department of Insurance and as otherwise set forth in this Subscription Agreement, the balance remaining in your SSA or eligible Surplus Contribution, after allocation of expenses and claims, will be returned to the Subscriber within six months thereafter. In the event that that the Subscriber should cease to maintain insurance with the Exchange, regardless of whether such insurance is cancelled, rescinded or non- renewed for any reason, you will lose all rights as a subscriber to the Exchange.

-

Acknowledgement of Receipt of Documents. The Subscriber hereby acknowledges and confirms receipt of, and represents and warrants to the Exchange and the AIF, that the Subscriber has read and fully understands, the SAC Charter and the Attorney-in-Fact Agreement prior to executing this Subscription Agreement.

-

Binding Agreement. This Subscription Agreement will be accepted by the AIF upon receipt of the Subscriber’s executed signature on the cover page. The Subscriber agrees that this Subscription Agreement, including the power of attorney set forth herein, will apply to all insurance policies for which the Subscriber has applied, or will apply, with the Exchange. The subscriber further agrees and understands that upon acceptance of this Subscription Agreement by the AIF, the terms and conditions of each of this Subscription Agreement, the SAC Charter, and the Attorney-in-Fact Agreement will be valid and binding upon the AIF, the Subscriber, and each of the parties’ respective personal representatives, administrators, successors, and assigns, as indicated by the Subscriber’s signature on the cover page.

-

Arbitration.

-

As a condition precedent to any right of action arising under or out of this Subscription Agreement, the Subscriber, the Exchange, and the AIF (each being individually referred to herein as a “Party,” or collectively as the “Parties”) agree that any and all disputes or differences concerning the Parties’ rights or obligations under this Subscription Agreement, including any and all disputes or differences concerning the formation and/or validity of this Subscription Agreement or the formation and/or validity of this arbitration provision, shall be submitted to arbitration before a panel of three arbitrators, each of whom shall be an active or retired disinterested officer of a property and casualty insurance company. For the avoidance of doubt, this arbitration provision is not intended to govern coverage disputes or differences arising from a policy of insurance issued by the Exchange to the Subscriber. One arbitrator shall be chosen by the Subscriber, one arbitrator shall be chosen by the AIF on behalf of the Exchange, and the third arbitrator will be chosen by the other two arbitrators. In the event any Party does not appoint an arbitrator within 60 days after the other Party requests it to do so, or if the two arbitrators selected by the Exchange and the AIF fail to agree upon a third arbitrator within 30 days of the appointment of the second arbitrator to be appointed, the arbitrator or arbitrators, as the case may be, will, upon the application of any Party, be appointed by the American Arbitration Association and the arbitrators will proceed. The decision of the majority of the arbitrators will be final and binding on all Parties. Each Party will bear the expense of its own arbitrator and one- half of the expenses of the third arbitrator and of the arbitration. Arbitration taking place under this section will take place in Louisiana unless otherwise agreed by the Parties in writing.

-

Any action, litigation, suit or proceeding arising out of or relating to this Subscription Agreement including the enforceability of the provisions of paragraph 14(a) hereof, shall be brought solely in federal or state courts of competent jurisdiction sitting in the courts located in the State of Louisiana , and each of the Parties hereto hereby irrevocably consents and submits to the exclusive jurisdiction of such courts.

-

Notwithstanding any dispute or difference of opinion arising under this Subscription Agreement, the Exchange and the AIF must fulfill all obligations under the reciprocal insurance contracts exchanged by the Joint Subscribers.

-

Assignment of Benefits. Subscriber may not, without the prior written consent of the SAC, assign Subscriber’s rights or obligations under this Subscription Agreement, in whole or in part, either voluntarily or by operation of law, and any attempt to make such an assignment in violation of this Section 15 shall be a default of this Subscription Agreement and such assignment shall be null and void and of no force or effect. Subscriber understands that any such default of this Subscription Agreement by Subscriber as a result of an assignment made in violation of this Section 15 may constitute grounds for expulsion from the Exchange, at the sole discretion of the SAC.

-

Non-Assessable Policies. Section 22:175 of the Louisiana Insurance Code provides, in pertinent part, that a domestic reciprocal insurer may issue policies without contingent liability of the Subscriber for assessment upon approval of the Commissioner of Insurance and upon compliance with the following requirements: (i) The Exchange shall have and at all times maintain a surplus as determined from its last annual statement, which is at least equal to the minimum capital and the paid in surplus required on organization of a domestic stock insurer organized under

the provisions of the Louisiana Insurance Code; and (ii) the Exchange shall have submitted a copy of its proposed non-assessable policy or policies for approval of the Commissioner of Insurance and shall have obtained his approval thereof. Accordingly, your liability as a Subscriber of the Exchange is limited to the premium contribution specified in your policy only if the unencumbered surplus of the Exchange is at least equal to the minimum capital stock and minimum surplus required of a stock property and casualty company.

-

General Provisions.

-

Governing Law. This Subscription Agreement and all matters relating to its validity, interpretation, performance and enforcement shall be governed by and construed in accordance with the substantive laws of the State of Louisiana, without giving effect to the principles of the conflict of laws or the rules thereof that might require the application of the laws of another jurisdiction.

-

Limitation of Actions. Absent a finding of criminal or willful misconduct or recklessness and except for causes of action that may arise directly from the Subscriber’s insurance policy(ies) or actions to enforce this Subscription Agreement which must be brought in arbitration pursuant to Section 14 above, the Subscriber agrees that the Exchange will not be sued or named in any action or affirmative defense by the Subscriber.

-

Rules of Construction. When a reference is made in this Subscription Agreement to a Section or subsection, such reference shall be to a Section or subsection of this Subscription Agreement unless otherwise indicated. Any capitalized terms used in any attachment to this Subscription Agreement but not otherwise defined therein shall have the meanings as defined in this Subscription Agreement.

|

Acknowledgment of Receipt:

Cajun Underwriters Reciprocal Exchange

Signature:

Name: David Flitman

Title: President and Chief Executive Officer of Manatee Risk Management, LLC.

Date: January 30, 2024

|